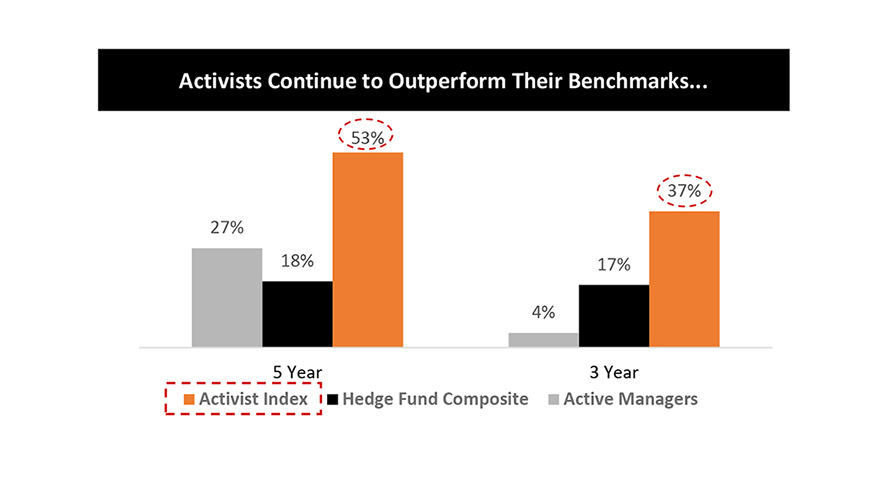

One of the main developments in public markets coming out of 2023 has been the significant evolution in shareholder activism and the widening range of targets that activists are focusing on to launch campaigns.

This was a year where shareholder activism truly transcended its conventional boundaries as the market evolved to targeting companies beyond the traditional tactics of attacking underperformers.

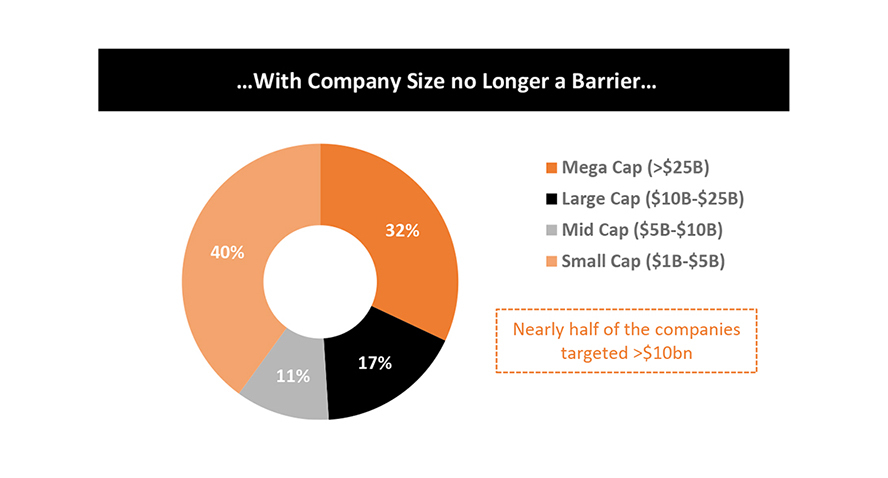

In 2024, we anticipate further significant shifts in the activist landscape, encompassing unconventional targets and innovative strategies. The activist world as we know it is evolving faster and in ways that were previously considered nontraditional. One of the distinctive aspects is that larger companies are getting targeted more frequently, and we believe this trend will continue in the year ahead. Simply delivering on financial performance and on expected financial metrics is no longer a barrier to entry for activists who have other ideas.

Why is this Relevant:

- Expanding Target List: Blue chips and Silicon Valley giants are now under scrutiny in activists’ screening radar

- Profit Focus: Activists prioritizing operational improvements and sustainable value creation, making cost-reduction initiatives a key focus

- Strategic ESG Evolution: ESG is no longer a marketing wedge to win over investors; there’s a shift towards targeted initiatives focused on financial performance

- Collaborative Ecosystem: Active managers increasingly collaborate with activists, creating a complex yet potentially cooperative landscape

- M&A Resurgence: Anticipated uptick in M&A activity demands preparedness, presenting both opportunities and challenges for activists

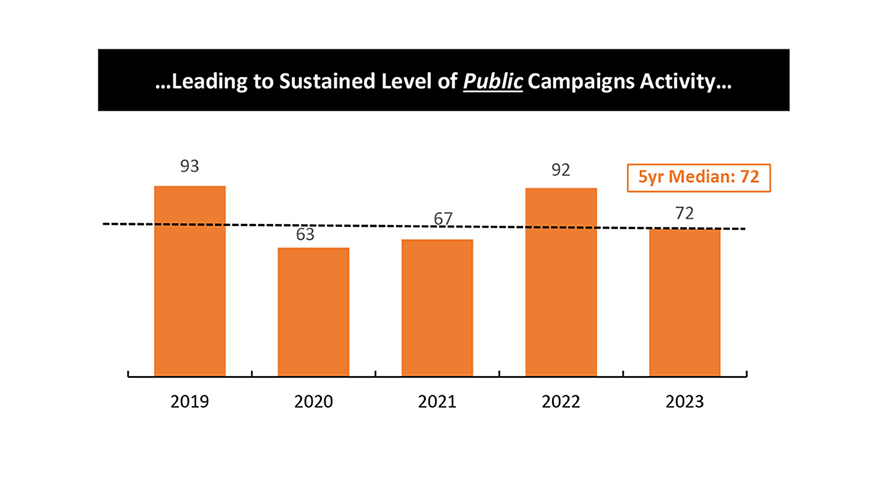

Source: Diligent Market Intelligence; All data is based on public campaigns by funds with “primary” or “partial” focus on activism at companies with market capitalizations >$1bn at campaign launch.

How We Can Assist You:

- Identifying Vulnerabilities: Meticulous analysis of your company’s exposure to potential activists

- Craft Strategic Defense: Develop tailored plans to address vulnerabilities and foster proactive investor engagement

- Leverage Financial Expertise: Utilize our deep understanding of capital markets to advise on optimal responses and potential value creation options

- Provide Board and Management Advice: Empower your leadership team to confidently navigate potential activist interactions

Please email consellofinancial@consello.com for a detailed shareholder activism report.