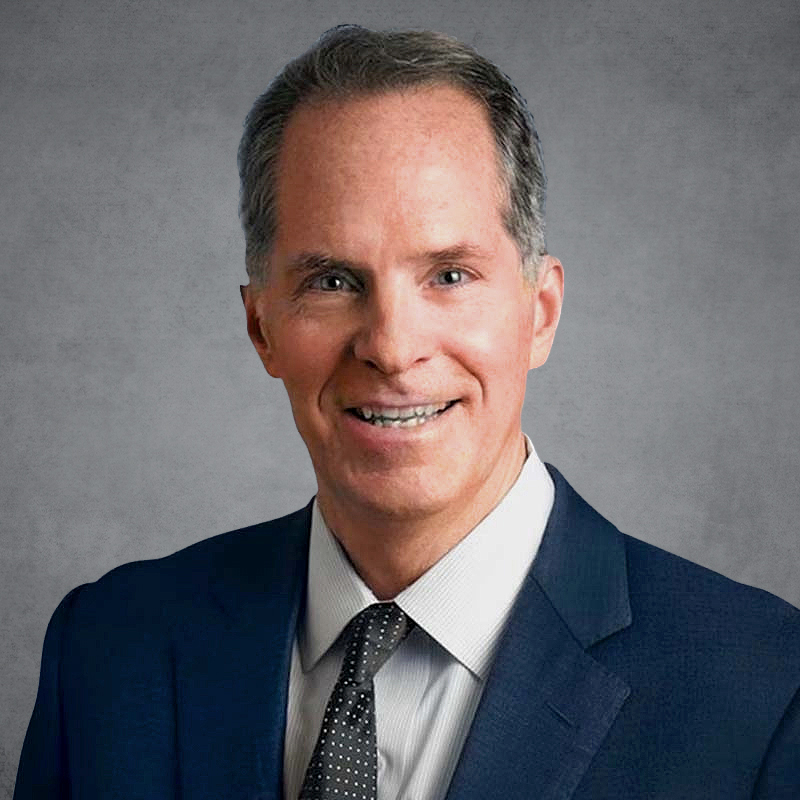

Blockchain will be additive to digitally forward industries, upgrading infrastructure with more efficient rails, ledgers and systems. We will still have a financial system with many of the features, components and operations that we have today, though it will surely be disrupted in ways that will make it faster, cheaper and more efficient.

-Itay Tuchman

The views and opinions expressed herein are solely those of the individual authors and do not necessarily represent those of The Consello Group. Consello is not responsible for and has not verified for accuracy any of the information contained herein. Any discussion of general market activity, industry or sector trends, or other broad-based economic, market, political or regulatory conditions should not be construed as research or advice and should not be relied upon. In addition, nothing in these materials constitutes a guarantee, projection or prediction of future events or results.

Read the full Article:

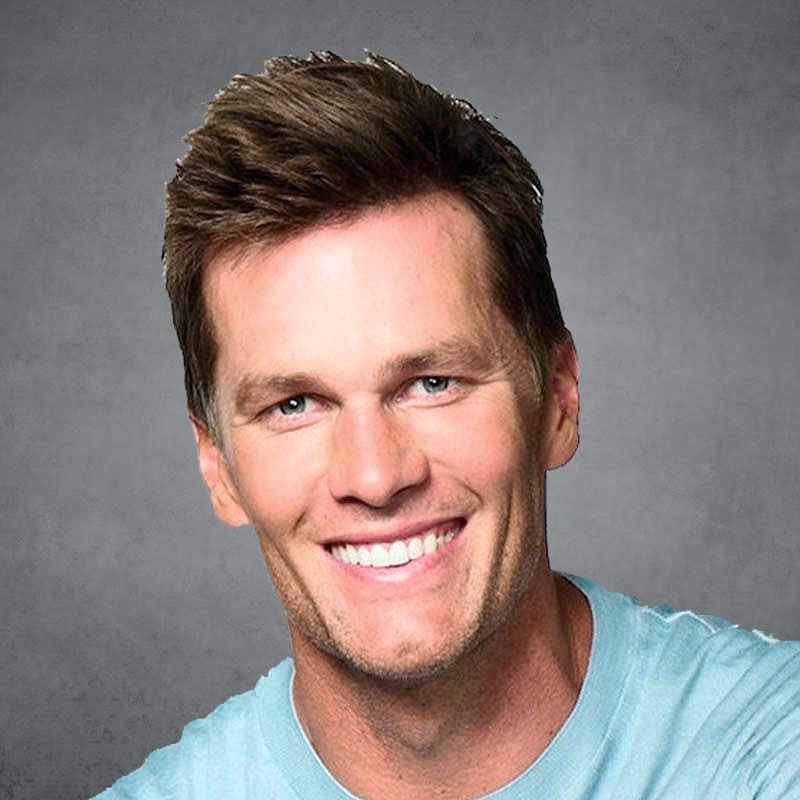

Itay Tuchman’s Executive Perspective

Read More

How Digital Assets Will Transcend Speculation and Go Mainstream

The first crypto bear market lasted almost two years. There have been multiple of these bull/bear cycles since Bitcoin launched in 2009, and indeed speculative excess is not new nor unexpected when a new technology captivates early adopters and ignites a major “disruption” narrative. More recently, the Digital Asset industry was roiled by the collapse of digital tokens TerraUSD and Luna, which began an ensuing domino effect in the space. Shortly thereafter followed bankruptcies of Celsius, FTX and other prominent crypto companies. And during the recent stress on the traditional banking system that saw the collapse of Silicon Valley Bank, two banks with ties to the crypto industry (Silvergate and Signature Bank) either wound down operations or were placed into receivership by regulators.